Online retailers come in many varieties.

– Some sell a variety of products, and some. like ours, have a very specialized niche.

– Some online retailers have employees, and some are owner operated.

– Some are a business and some are more of a hobby.

– Some are a full time job for the business owner, and some are a side job. Some, provide no income at all.

– Some, provide products you can’t find anywhere else.

Typical small business

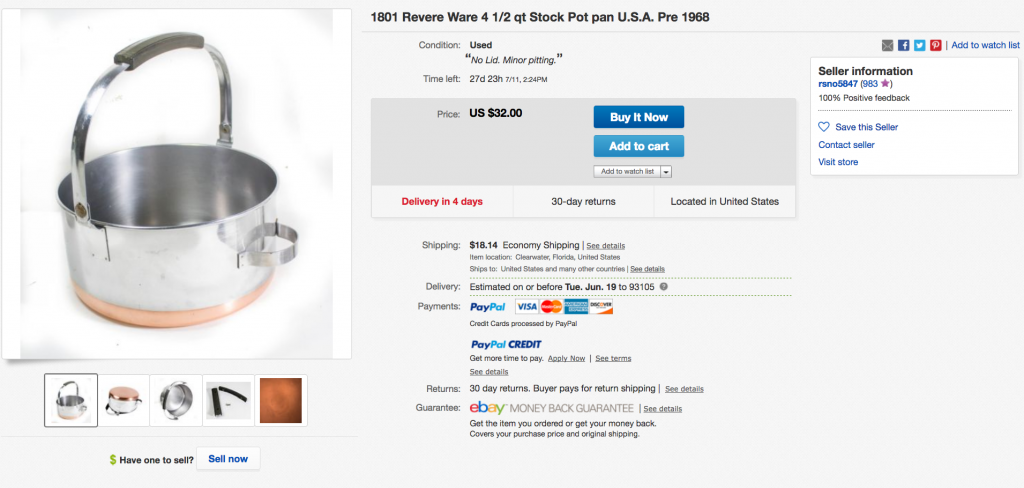

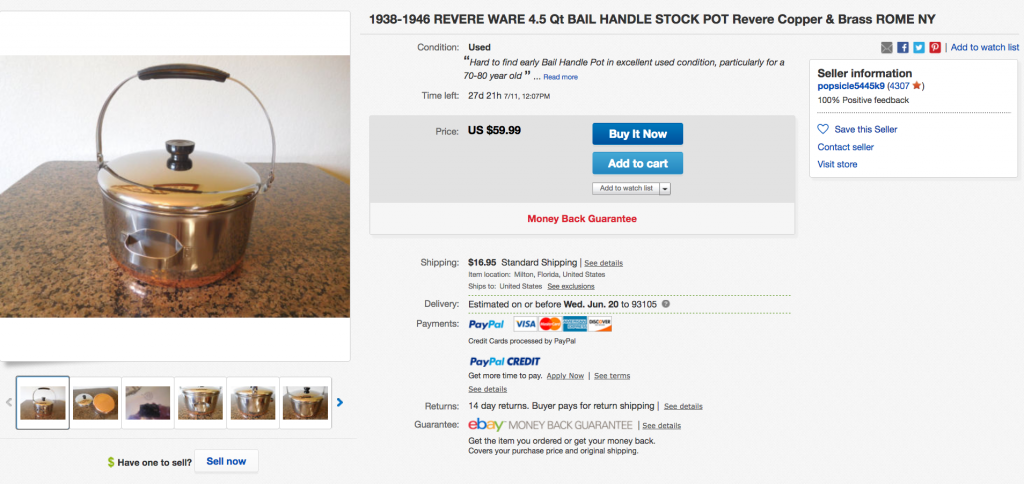

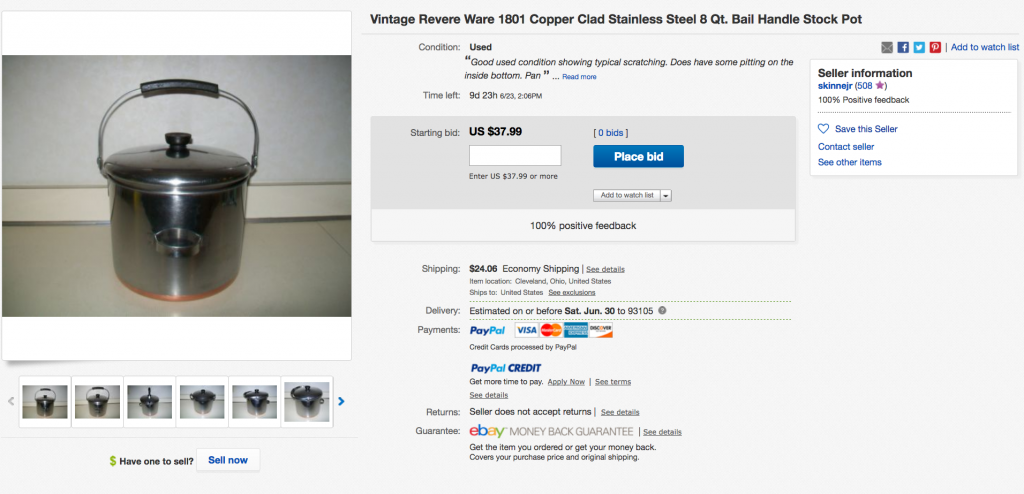

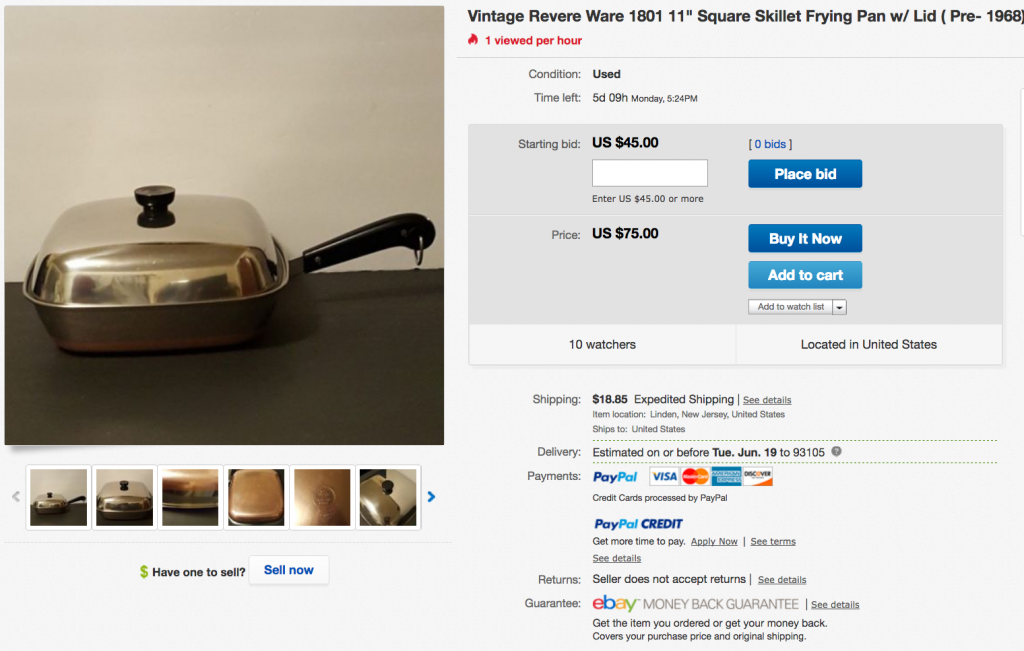

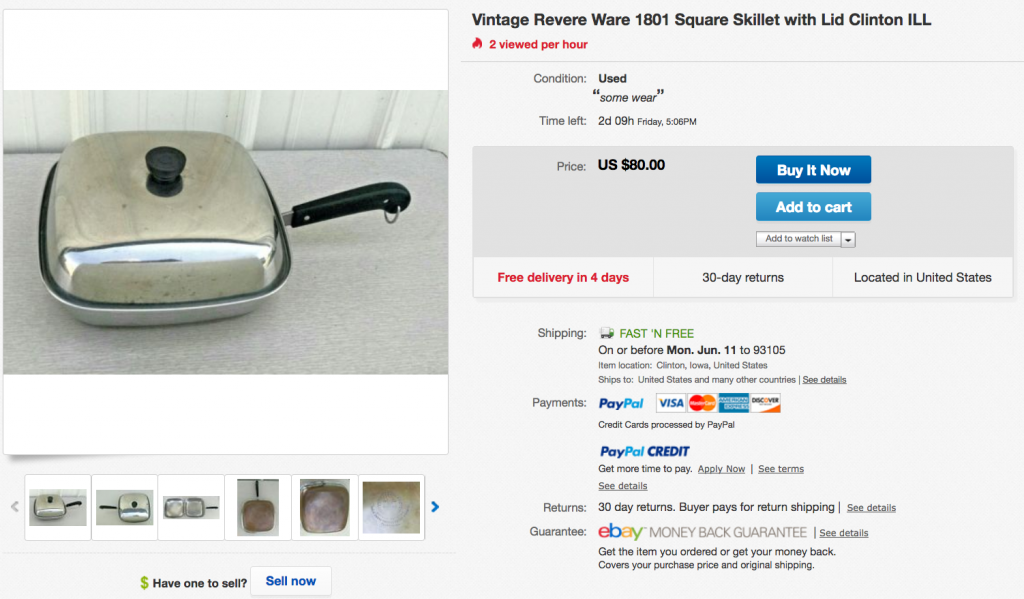

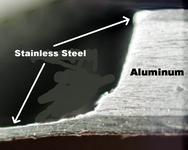

I got my start in this business based on a need. We were looking for replacement handles for some old Revere Ware and couldn’t find any. Based on our need, the fact that the company that made Revere Ware, stopped selling replacement parts three decades before we came on the scene, and the large number of Revere Ware pieces that had been sold, I presumed that there was a good opportunity.

So I went through the trouble to get replacement parts manufactured, set up a website with lots of useful information and quite a few replacement parts for sale, and have served the community of Revere Ware cookware owners for almost a decade now. Our story is probably not that uncommon among the small businesses that sell online exclusively. This guy makes really cool devices that are useful for getting the most out of vintage Apple computers. Like us, he serves a small community of customers and potential customers, and his products are incredibly useful for that that need it.

Supreme pain in the *!@#$%

Among this backdrop, consider the Supreme Court ruling that came out this week, which opens the door for South Dakota to require people selling into South Dakota, but who aren’t located in South Dakota, to collect sales tax on the state’s behalf.

Our average order total is between $10 and $20. We fulfill thousands of orders each year (not hundreds, not tens of thousands). Right now, we are required to collect sales tax only in our home state, home county, and home city.

Despite the fact that we are more than 20 years into online retailing, quite frankly, the software we use to run our website, is horrible when it comes to extracting data. Every year, in order to collect the data the California requires us to report about our sales, we spend quite a bit of time slicing and dicing the sales data to figure out exactly how much sales tax we collected, much less all the other data California wants, like breakdown of sales inside and outside the state, county, city.

Even if better eCommerce software was available, switching is expensive. The last time we updated our website and move to a new platform, it cost us about $10,000.

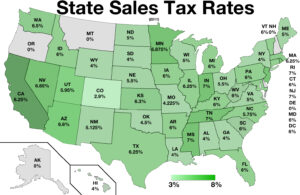

We deal only with 3 tax jurisdictions. In the US there are over 12,000 state and local tax jurisdictions. It isn’t too hard to imaging how requiring online retailers to collect sales tax could become a nightmare that puts retailers like us out of business. Among the myriad of problems:

– We only have to keep up with three rates right now – one state, one county, and one city. Requiring us to keep track of and set up to collect 12,000 different tax rates would be simply impossible. Even 50 or 100 would be substantially more work.

– We only have to file one sales tax return right now, which only includes one state, one county, and one city tax and revenue breakdown. How in the heck would we file when considering 12,000 jurisdictions?

South Dakota has an exclusion for any business with less than $100,000 or 200 individual sales in the state. But, for us just to be able to figure out for 50 states whether we are above or below the limit or revenue and transactions will require a lot of work. And given that we make quite a few sales of small amounts, we will undoubtedly be above such limits in some states. There will definitely be a crossover point where we just throw up our hands and say “it isn’t worth it anymore.”

A better solution

In my opinion, there needs to be a solution at a Federal level to solve this problem. This is what I would want:

1. A flat sales tax for online sales that applies to every business every where.

2. A single authority that collects and distribute sales tax revenue to the states, counties, cities.

This presumes a couple of things:

– That 50 states and / or more than 12,000 tax jurisdictions can agree how to apportion tax revenue among themselves.

– That states with higher sales tax than the agreed upon common flat sales tax rate, will agree to accept a lower rate for online sales

Which is basically saying it probably won’t happen But what if it did? It would sure make my life easier, and it would remove the barrier for a lot more small businesses to open up. Every single bit of bureaucratic filings and fees makes it that much harder for a small business to form and stay in business. Perhaps you haven’t heard, but small business formation is down to about 2/3 of historical norms. It isn’t hard to imagine that bureaucracy has a lot to do with this.

Government entities are sometimes greedy and unreasonable

Remember that, in addition to the requirements for collecting sales tax and filing returns, there is always the threat that any tax jurisdiction can file an action against a business demanding that they pay a presumed amount of sales tax, or prove that they don’t have to. Thing this is far fetched? Let me tell you as story.

In California, and probably other states, businesses are required to pay business property tax on assets. Imaging having to go through everything the business owns, assign it a reasonable value, and then pay property tax on that value, just as you would on real estate.

But there is an exclusion. If you have less than a certain amount of assets, you don’t have to pay. But you are _supposed_ to file a return anyways, proving that you don’t have to pay. It is just another bit of red tape. I now my business assets are below the threshold required to pay this business property tax, so I never bothered to file a return (who has the time). So someone that works for the local assessor decided one day to just randomly assign a presumed value of assets that would guarantee I would owe business property tax, and send me a bill … to the wrong address, even though they had my proper mailing address. Months go by and someone slips one of these letters from the assessor under my door, as they happen to recognize my business name. Now they are charging me late penalties as well. Two years later, after filing an appeal with the County Board of Supervisors, and winning, I am still having trouble getting the assessor to remove the assessment from their system.

Now multiply this experience by 12,000 tax jurisdictions and you’ve just killed every small business.