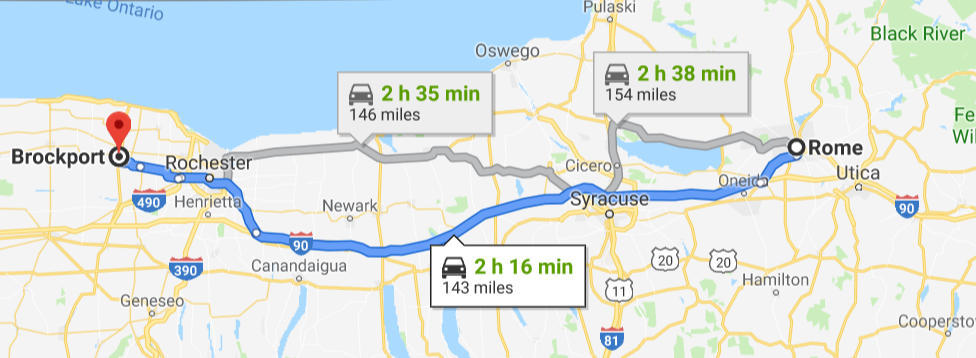

I suppose this was bound to happen. We’ve written before about retail arbitrage, where some eBay sellers relist items available on Amazon.com for a higher price than you might otherwise pay there, and simply have the item “drop shipped” to you from Amazon.com, when you purchase on eBay. This essentially means just purchasing the item on Amazon.com and entering the eBay buyers address as the shipping address.

Of course, there are websites that providing information on setting this up.

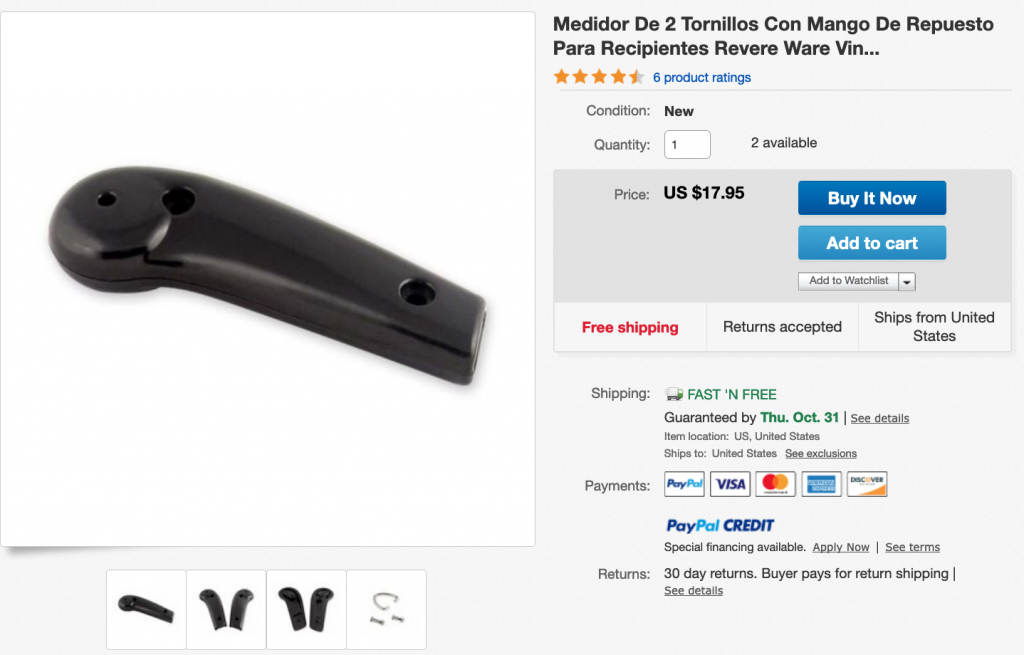

The most recent twist to this is that we’ve found listings for our parts now in Spanish.

Note that eBay’s official policy is that this practice is not allowed:

Drop shipping, where you fulfill orders directly from a wholesale supplier, is allowed on eBay. Remember though, if you use drop shipping, you’re still responsible for the safe delivery of the item within the time frame you stated in your listing, and the buyer’s overall satisfaction with their purchase.

However, listing an item on eBay and then purchasing the item from another retailer or marketplace that ships directly to your customer is not allowed on eBay. In such cases, we may remove your listings from search, display them lower in search results, or remove them completely from the site. We may also limit, restrict or suspend your ability to buy, sell, or use site features on eBay, and you could lose any special status and/or discounts associated with your account.

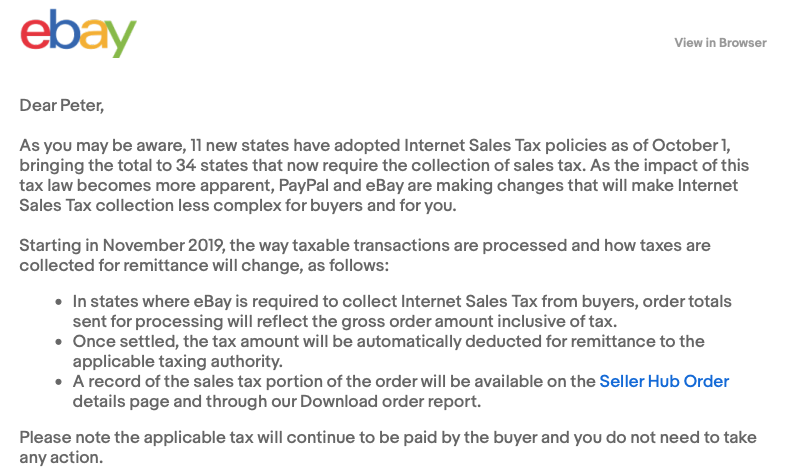

A more nefarious twist to this practice is that some scammers use stolen credit cards to purchase the items from Amazon.com to fulfill the purchase on eBay; this is called triangulation fraud.

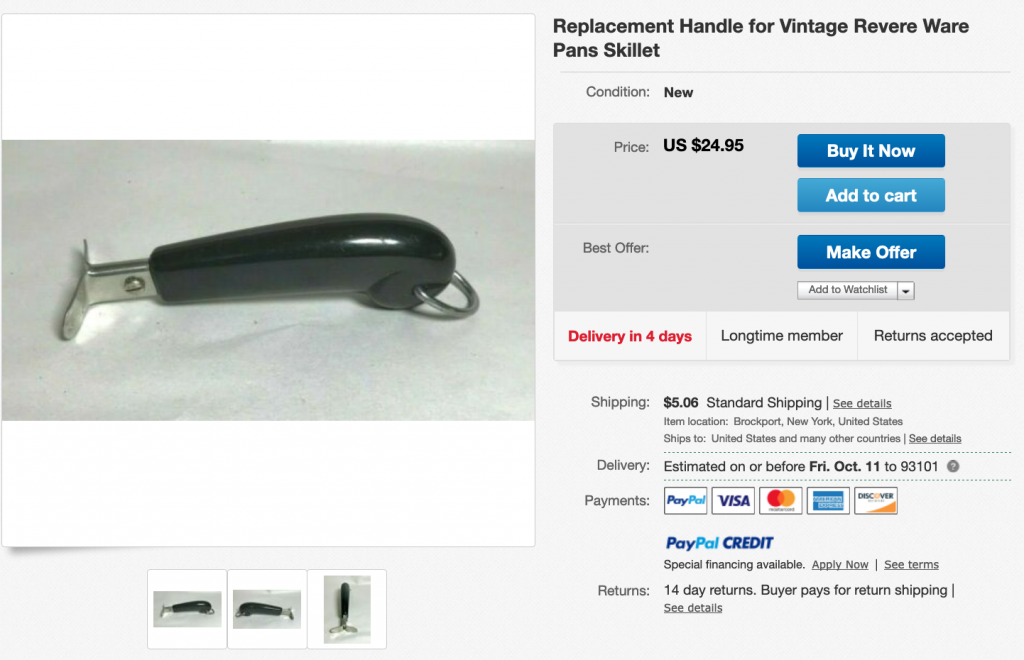

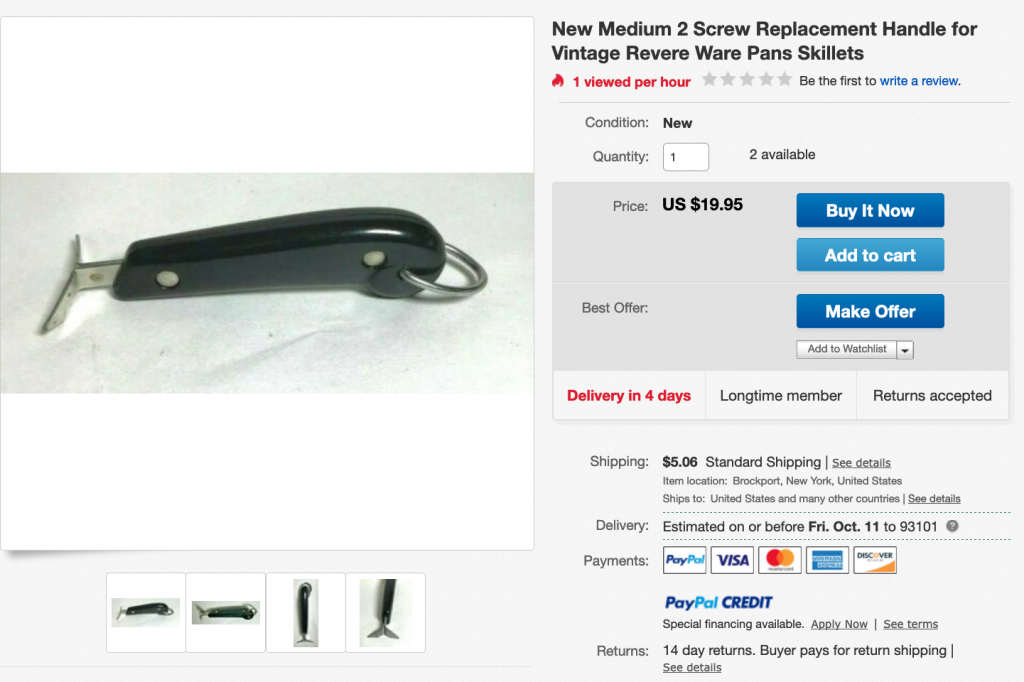

The bottom line is that, it is generally a bad idea to buy our parts on eBay for a number of reasons.

- There is a high risk of fraud

- You get no guarantee at all if anythng goes wrong or you get a defective part. These sellers are about as fly-by-night as they come, and will just close up shop and open a new account if their feedback becomes negative.

- You are paying more than you would just buying it on Amazon.com

- The sellers are selling in violation of eBay’s policy.

Please buy just from our website or from our store on Amazon.com. We are the only authorized sellers of our parts and we don’t sell on eBay. If you buy from us, we guarantee a good experience and will replace your part if it is defective.