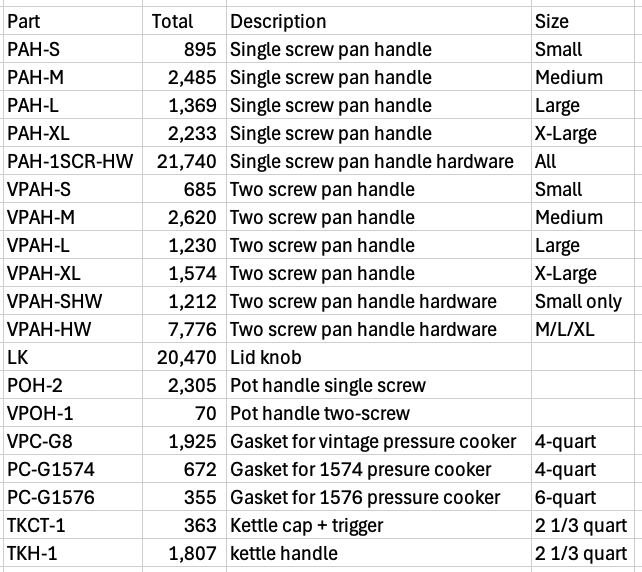

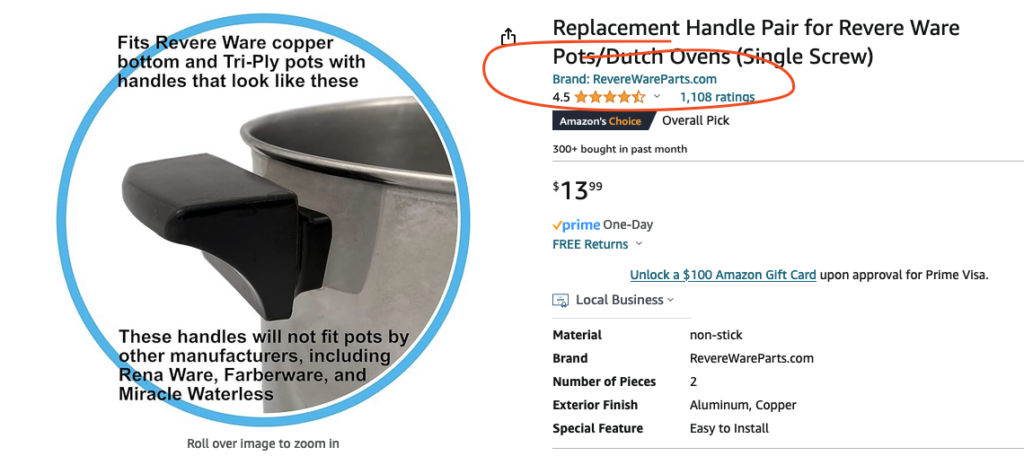

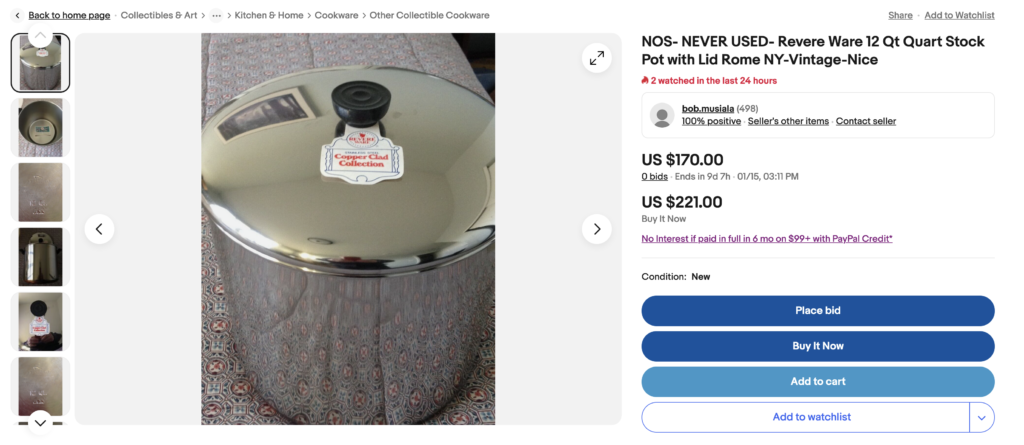

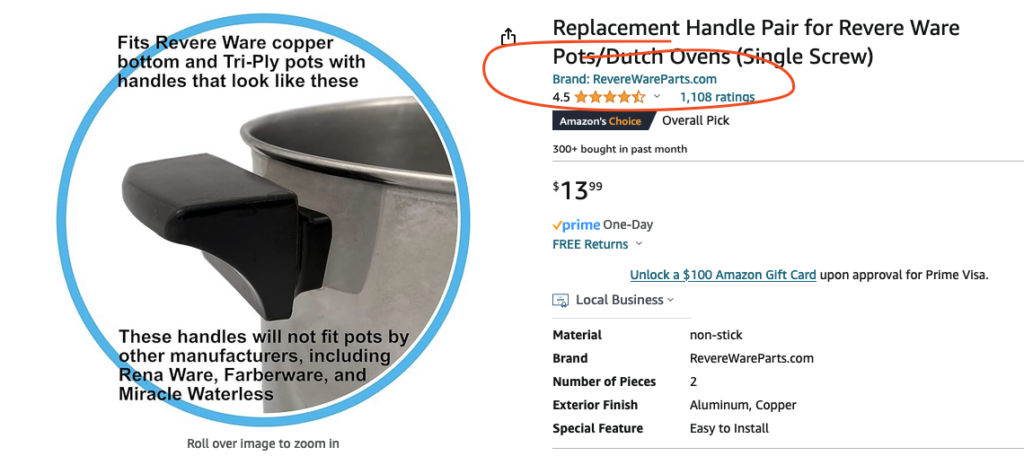

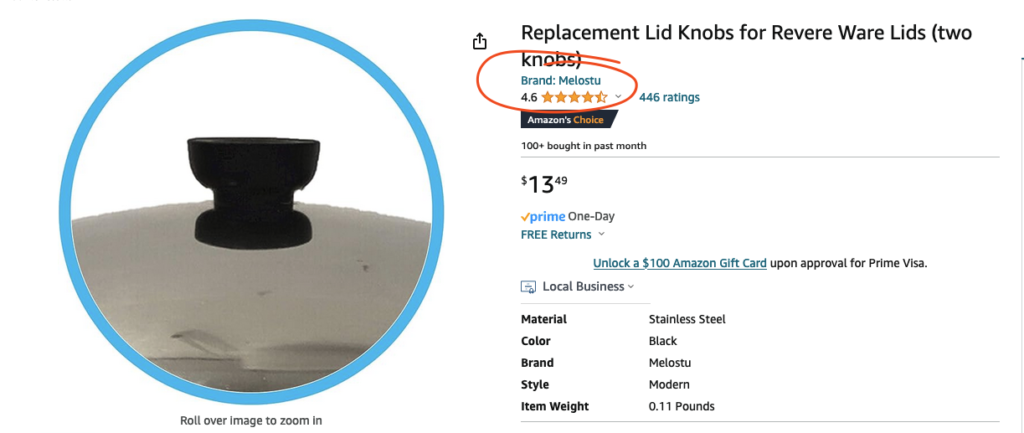

The latest threat to this business is unsavory Amazon sellers hijacking our product listings. Here is what a normal listing on Amazon looks like. Notice that we are listed a the brand.

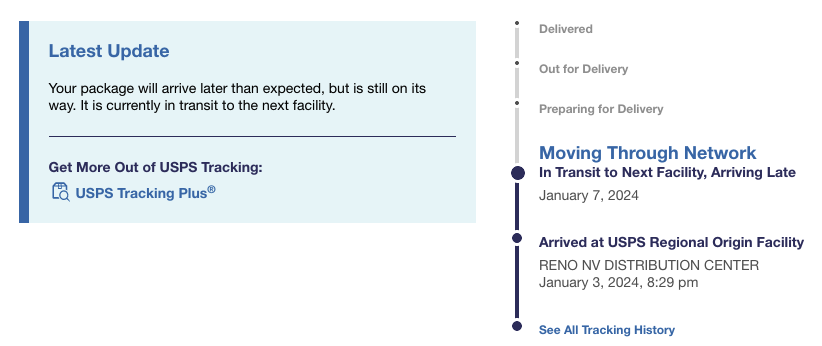

Here is one of the (so far) six hijacked product listings.

The product listings haven’t been altered yet, but I have no doubt this game is about replacing the product I sell with another one on the same listing, and tricking people into believing the ratings and reviews are for the new product.

With the items now associated with another brand, we have to “ask for permission” to be able to send products for sale, so this prevents us from shipping additional inventory.

The only way Amazon allows people to prevent this is by registering a trademark and creating an official brand on Amazon with the trademark. Sounds simple but the last trademark application I was involved with took several years, multiple submissions, and tens of thousands in attorneys fees; they aren’t as simple as they seem.

This doesn’t bode well for the future my of selling Revere Ware replacement parts. As dealing with Amazon (excessive returns, customers with attitude that don’t bother reading anything, poor customer service, ridiculous policies, removed listings, hijacked listings) becomes more and more of a hassle, I just can’t see continuing to sell items there. I’ve already stopped selling a half dozen of our parts there due to excessive returns. If our few big sellers get hijacked and we can no longer send inventory, that’s probably the end of Amazon selling.

Without the Amazon sales volume, the rest of the business doesn’t make a lot of sense for the effort.

We’ll see how it goes this time around with their support. If I am unable to get any help in this, it is probably the beginning of the end for this business. I can imagine winding things down by the end of this year. Being able to take a vacation without answering customer service emails might be a nice change. 🙂

So consider this a warning shot, our replacement parts might not be available much longer. Stay tuned.

Update 2/12/24

Oh what a mess Amazon’s support is. A case filed under one issue type they told me to file it under another issue type. Then that case they told me it would be transferred to another group that could help and I would be contacted but wasn’t. Then I opened a new case and they told me to file under the account health dashboard | listing policy violation. This approach managed to get three of the six listings transferred back to my brand ownership, but the other three just kept coming back as “no violation found”. I am now six replies deep in another filed case trying to get them to get a clue. For example, a typical response from Amazon:

We cannot make the suggested brand change to ASIN B017GRFQBW B0170TXUNM B0170TEWUW.

Kindly note that the detail page associated with this ASIN is controlled by the brand owner. Any product-related information on this ASIN must be submitted by the brand owner.

Right, that is exactly the problem I had to remind them for the umpteenth time. So I am still in limbo on three of my listings, hoping for the best.